Geico v. Liberty Mutual car insurance

I have had Geico for 17 years, and they have been great. Very good customer service on the phone, and when I have had accidents, they have been easy to deal with--and didn't raise my rates. By far the best experience I have ever had with a major company.

I found Liberty Mutual obscenely expensive -- even with the AARP "discount".

I've had Geico the last 5 years and have had no problems with them (nor have I filed any claims). However, I have just switched to Allstate because their bundled auto rate was $100 less per 6-month policy than Geico, with slightly better coverage.

I've had both and have had claims with both. Liberty mutual increased rates more quickly, coverage for claims was equally smooth. Happy with Geico now and saving money

We had Geico for a few years, but the premiums kept going up and I found a better deal with Liberty Mutual. Now, in our third year with LM, the premiums are going up just as insanely, and that's with a so-called "Affinity Group" savings.

Our new bill for 2 cars that we drive to work in NJ is $2633 not including the PLIGA surcharge. Without any claims or points, our bill went up 6.5% in one year. Our deductibles are $500 comprehensive/collision, and there is some PIP coverage in there, which I can never really figure out if we need or not. That PIP premium is a substantial portion of the total bill.

I shudder to think what the premium will be once we have to add our son to the policy, who will start learning to drive in about a month. I assume we have to call them once he gets his learner's permit, no?

We've also had Geico for many years. We've looked around and have compared many prices but inevitably, Geico still remains the lowest. Now that we've added a teen to our policy, Geico in comparison to others is still the lowest, albeit HIGH, but the lowest.

I'm trying to overcome the feeling that it's suspiciously low. Thoughts?

Part of the reason may be that agents for Liberty Mutual get a commission, while there are no agents, and hence, no commission, for GEICO.

Geico is suspiciously low? Not really, but I think they are lower than others.

We had Liberty many years ago, and switched to Geico to save money. No issues to date. Also, my bodyshop guy is always able to get Geico to cover OEM parts when needed, although I think he mentioned that other insurance companies may give him less struggle about it.

My husband recently reviewed all our our insurance needs with the agent who also handles our Chubb homeowners and they found nothing wrong with Geico's coverage and also nothing else could compete premium-wise.

jules867 said:

I'm trying to overcome the feeling that it's suspiciously low. Thoughts?

Hi - what did you end up doing? I have the same concern - Geico quoting me (via phone) a rate that is far below our Allstate autorate. Allstate has gone higher and I know we can do better. But Geico is quoting about $2,0000 less annually, which is hard to believe. On the other hand, Geico's quotes on Homeowners and Umbrella/liability weren't anything special (and the phone reps didn't seem very knowledgeable).

I have Geico and haven't had any problems with claims. I got hit a few months ago and the claim was handled without issue. I was able to choose my body shop which has always been Wilman's. And my rental car(s) were covered as well. No out of pocket for me.

mumstheword said:

I found Liberty Mutual obscenely expensive -- even with the AARP "discount".

I've had Geico the last 5 years and have had no problems with them (nor have I filed any claims). However, I have just switched to Allstate because their bundled auto rate was $100 less per 6-month policy than Geico, with slightly better coverage.

I had Liberty Mutual for several years. But every year they had rate increases leading to about 3200 a year.

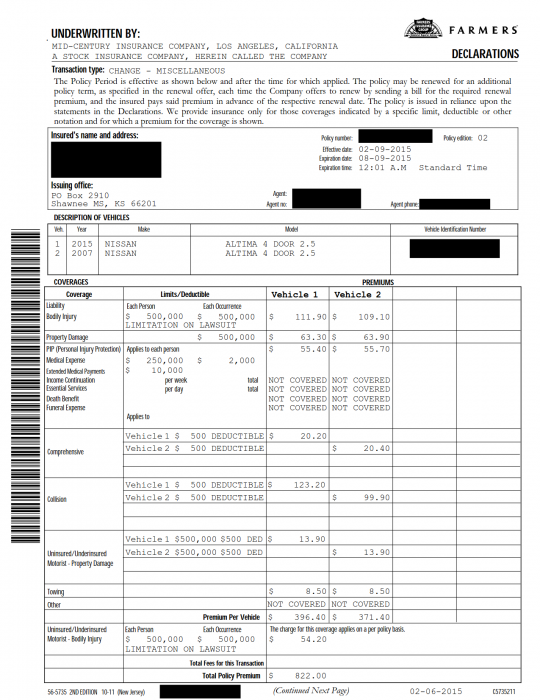

I got a new insurer, same policy coverage, for 1650 a year for both cars, a 2007 and 2015 Nissan Altima. When I called Liberty Mutual to cancel, they told me they have a "new" plan which gives me the same coverage as the current plan at a much lower rate. I said "nice of you to tell me now, but too late."

My new policy:

I know agents that work for GEICO and they get paid commissions (only they call it production based incentives).

When I shopped around, Farmers (right on top of dunkin donuts in S. Orange) was the cheapest (and for 3 cars was $800 less than GEICO).

krnl said:

Part of the reason may be that agents for Liberty Mutual get a commission, while there are no agents, and hence, no commission, for GEICO.

bog said:

Did you work with a farmer's agent or was it online?

Farmer's agent. I went to my favorite family owned "collision" place to get a mirror replaced. The owner, Lorrie, told me they got new insurance for themselves through this Farmer agent they met and that he saved them a lot of money on their insurance.

I called the agent, got quotes and switched my car and house insurance.

Fabian S Howe

732 333 3519

We switched house+cars from LM to GEICO two years ago when GEICO slashed their rates. We love GEICO. Never had a claim with any carrier, though, so can't speak to that.

I had Liberty Mutual from the time I started driving until I was 50. They never did anything for me except raise the rates. Although I still use them for my homeowners because my lawyer said they are the best. I'm not so sure but I haven't shopped it either. I did put in a homeowners claim a few years ago and they surcharged me for 3 years which I thought was absurd.

fabulouswalls said:

I had Liberty Mutual from the time I started driving until I was 50. They never did anything for me except raise the rates. Although I still use them for my homeowners because my lawyer said they are the best. I'm not so sure but I haven't shopped it either. I did put in a homeowners claim a few years ago and they surcharged me for 3 years which I thought was absurd.

Ask your lawyer: What is it they are the best in? Surcharging?

My lawyer specializes in insurance. And I don't have to pay to ask a question.

jasper said:

I shudder to think what the premium will be once we have to add our son to the policy, who will start learning to drive in about a month. I assume we have to call them once he gets his learner's permit, no?

Our rates didn't go up until our kids got their actual licenses, but they did go up a lot then.

I've had a few claims, unfortunately, with GEICO and they are fantastic in the customer service area. Automated where they should be and always available on the phone when they should be. And always quick as can be. No waiting for adjusters, for reimbursements or for anything. I haven't shopped the rate in a few years so I can't speak to price competitiveness.

sac said:

jasper said:Our rates didn't go up until our kids got their actual licenses, but they did go up a lot then.

I shudder to think what the premium will be once we have to add our son to the policy, who will start learning to drive in about a month. I assume we have to call them once he gets his learner's permit, no?

With Liberty Mutual our rates went up very little when our daughter got her license (and, that's when you add them to the policy; not with the permit). She doesn't have her own car. My understanding is that that's when you see the big increase.

Resurrecting this thread with the arrival of my latest Liberty Mutual bill, which went up 3.6% since last year. Our son will be getting his license in July. Is it our responsibility to add him to the policy, or is there some kind of automatic reporting when he is issued a license? We are not buying him a car, but presumably he will drive our cars when we're not using them.

Any further thoughts on the LM vs. GEICO vs. Farmers debate? I suppose it can't hurt to call around and ask for quotes.

I love Geico. We've had them since we moved to NJ in 2000 and still here in CA. Every couple of years I get quotes elsewhere and no one can beat them. We've had a couple of claims over the years and they've been awesome - their customer service is top notch. Even recently, kid got her first car and they walked me through everything. Our rates did not go up when she got her license fyi - only when we added the extra car. I have no qualms about them. Plus their online interface is great.

We went with Geico back when we purchased our car when we were still Manhattanites. As both my wife and I hadn't owned cars for a long time every other insurance carrier we checked with was essentially punishing us for not having insurance. Geico didn't care and even gave us a discount for having a clean driving record (we did rent cars and use Zipcar quite a bit before taking the plunge.) As a result they were about 1/3rd the price of anyone else and quite reasonable.

It's hard to compare rates over the years, as moving from Manhattan to Northern New Jersey is not an apples to apples comparison, but we've been quite happy with them. We've never had to make a claim, but I've always kept my ears open to see if anyone had complaints about them and I've not heard anything.

I switched from Geico to Farmers - stictly based on the premium. For three cars, we saved about $500/year. No claims (ever). Farmers went up about $300 this year but still less than what Geico has quoted. Liberty Mutual was far more.

cubby said:

sac said:

jasper said:Our rates didn't go up until our kids got their actual licenses, but they did go up a lot then.

I shudder to think what the premium will be once we have to add our son to the policy, who will start learning to drive in about a month. I assume we have to call them once he gets his learner's permit, no?

With Liberty Mutual our rates went up very little when our daughter got her license (and, that's when you add them to the policy; not with the permit). She doesn't have her own car. My understanding is that that's when you see the big increase.

We had an extra car (inherited from my parents) at the time our teen got her license, so the insurance company required us to list her on the third car when we added her to our policy. (We couldn't name one parent as principle driver of more than one car as we had previously, once there was another driver insured.)

Trying to decide between the two and looking for advice. Geico is significantly less for seemingly the same coverage. Would love to hear thoughts/experiences from others. TIA!