The GOP Tax Reform/Cuts Plan

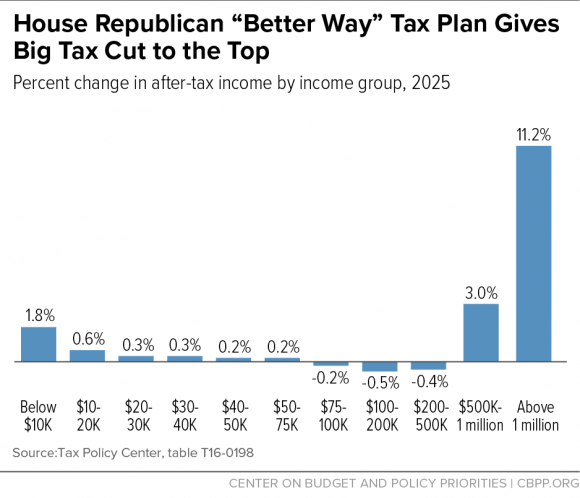

Your third chart shows increases to everyone earning $75K-$500K

So, almost everyone on MOL

Here's a short list of winners and losers:

THE LOSERS

Student loan borrowers

Ph.D. students

Teachers

People in states with higher income taxes

Families who adopt

People who move for work

Electric vehicle buyers

Wind energy producers

The sick

THE WINNERS

Donald Trump's children

People with aggressive accountants

http://www.rollingstone.com/politics/features/gop-tax-plan-the-biggest-winners-and-losers-w511391

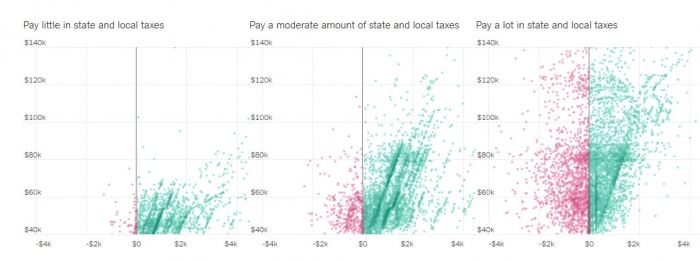

The problem with the average tax by income group table it is a country average. What we need for the above is by state. The table is meaningless for us.

Low tax states will show a greater income increase.

High tax (property and income) states will show radically different numbers. I wouldn't be surprised if the average 75 to 100K income will show an average decrease of 3 to 4K.

NJ residents will have to decide to take the higher standard deduction that lacks the personal exemptions or take itemized with a major reduction in deductibles.

True. I thought of that after posting it. But they do have a section - you need to scroll down - "People who pay a lot in state and local taxes could see big tax increases"

I see.

What's interesting is the people who gain the most are low voter density low local tax states. States where the electoral college bias is favorable.

BG9 said:

I see.

What's interesting is the people who gain the most are low voter density low local tax states. States where the electoral college bias is favorable.

The Republicans are intentionally targeting high-tax blue states like NJ, NY, and CA. They’re not even denying it.

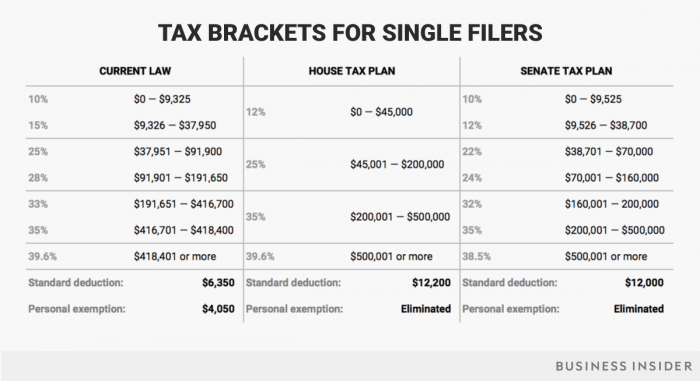

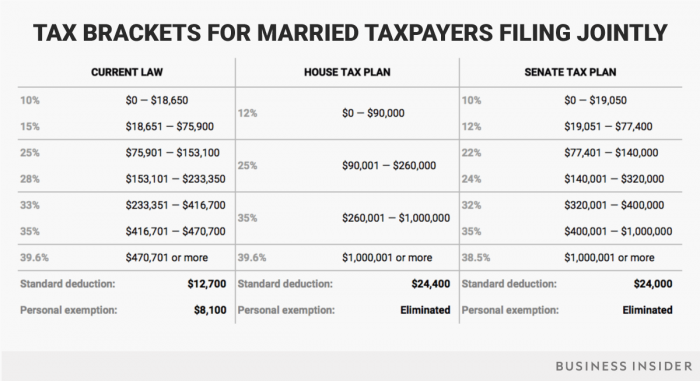

12K increase in standard deduction is wiped out if a family has more than 3 exemptions (i.e. more than one child in a two-parent family.) How does that help families at any income level?

it doesn't

sac said:

12K increase in standard deduction is wiped out if a family has more than 3 exemptions (i.e. more than one child in a two-parent family.) How does that help families at any income level?

Just read in the Times that a measure to open the Arctic National Wildlife Refuge to oil exploration is stuck in the tax bill. How awful!

Trump is highly leveraged, that is, lots of debt.

As is the case with properties owned by most developers, Mr. Trump’s properties appear to be highly leveraged. While he has not disclosed his exact borrowings, he has called himself the “king of debt” and a New York Times investigation found that his companies had borrowed at least $650 million. Other estimates have gone above $1 billion.

Trump Says Tax Bill Will Hurt Him. He’s Got to Be Kidding.

The new tax law will increase his profitability immensely. So what he couldn't make as a failed businessman (remember his many bankruptcies?) will now be "corrected" by us, the taxpayers.

BG9 said:

Trump is highly leveraged, that is, lots of debt.

As is the case with properties owned by most developers, Mr. Trump’s properties appear to be highly leveraged. While he has not disclosed his exact borrowings, he has called himself the “king of debt” and a New York Times investigation found that his companies had borrowed at least $650 million. Other estimates have gone above $1 billion.

Trump Says Tax Bill Will Hurt Him. He’s Got to Be Kidding.

The new tax law will increase his profitability immensely. So what he couldn't make as a failed businessman (remember his many bankruptcies?) will now be "corrected" by us, the taxpayers.

Will the loss of the property tax deductions hurt him at all? Misery loves company.

Morganna said:

BG9 said:

Trump is highly leveraged, that is, lots of debt.

As is the case with properties owned by most developers, Mr. Trump’s properties appear to be highly leveraged. While he has not disclosed his exact borrowings, he has called himself the “king of debt” and a New York Times investigation found that his companies had borrowed at least $650 million. Other estimates have gone above $1 billion.

Trump Says Tax Bill Will Hurt Him. He’s Got to Be Kidding.

The new tax law will increase his profitability immensely. So what he couldn't make as a failed businessman (remember his many bankruptcies?) will now be "corrected" by us, the taxpayers.

Will the loss of the property tax deductions hurt him at all? Misery loves company.

It won't hurt him. The loss of the property tax deduction only applies to residential properties (in which the taxpayer lives,) not commercial properties. Property taxes on commercial properties are a business expense.

eta - You didn't really think that developers would allow that to happen?

As someone who is anti tax and watches this stuff for a living, this is going to cost NJ residents a lot. Couple that with Murphy in office and we could be seeing significant tax increases. This is a bad plan, for many reasons. The image of Ryan and Trump holding a post card was laughable until you realize that most people could probably file their returns in that manner.

The corporate changes are needed but the individual change are, IMO, a rather large FU to the already high tax (both income and property) states that voted blue.

They proposed one small change to the "carried interest" requiring people to hold the interest for three years. Thank heavens for small favors.

Corporate changes may be needed, but they already pay nowhere near the rates listed. They deduct so much that the actual rates don't matter. Didn't Exxon pay about .02% last year?

sportsnut said:

As someone who is anti tax and watches this stuff for a living, this is going to cost NJ residents a lot. Couple that with Murphy in office and we could be seeing significant tax increases. This is a bad plan, for many reasons.

We can thank Christie for further bankrupting NJ. Eleven NJ credit downgrades during Christie's watch.

Which is typical of Republicans. Don't raise or even lower taxes, like Kansas. Cut services or borrow like crazy and then leave it up to the Democrats to pick up the pieces.

If this thing passes, any Republican who's not a millionaire and stays a Republican is a freaking masochistic moron.

drummerboy said:

If this thing passes, any Republican who's not a millionaire and stays a Republican is a freaking masochistic moron.

They will patiently wait for the wealth to trickle down.

Now that Trump has gone to bat for a likely child molester, decided that the remarks on the Access Hollywood Tape for which he apologized were not really made by him, and retweeted Nazi Hate propaganda anyone who is still a Republican is evil or seriously deluded.

it might be time to get out of NJ before housing prices plummet.

It might be time to get out of the US.

http://foreignpolicy.com/2017/11/30/this-is-how-every-genocide-begins-trump-retweets-muslim-hate/

FilmCarp said:

Corporate changes may be needed, but they already pay nowhere near the rates listed. They deduct so much that the actual rates don't matter. Didn't Exxon pay about .02% last year?

I was referring more to the territorial system as opposed to the corporate tax rate. And there are some good changes in the corporate tax proposal. Extending the limitation on executive comp and removing some of the loopholes. Limiting interest deductions. etc.

regardless of any "good" parts, corporations are swimming in record profits, and like the wealthy, are the last people that need any tax cuts. Particularly if it's being financed with debt. We should be, in a sane world, financing infrastructure spending with that debt, not giving more money to gazillionnaires.

sportsnut said:

FilmCarp said:

Corporate changes may be needed, but they already pay nowhere near the rates listed. They deduct so much that the actual rates don't matter. Didn't Exxon pay about .02% last year?

I was referring more to the territorial system as opposed to the corporate tax rate. And there are some good changes in the corporate tax proposal. Extending the limitation on executive comp and removing some of the loopholes. Limiting interest deductions. etc.

cramer said:

Morganna said:

BG9 said:

Trump is highly leveraged, that is, lots of debt.

As is the case with properties owned by most developers, Mr. Trump’s properties appear to be highly leveraged. While he has not disclosed his exact borrowings, he has called himself the “king of debt” and a New York Times investigation found that his companies had borrowed at least $650 million. Other estimates have gone above $1 billion.

Trump Says Tax Bill Will Hurt Him. He’s Got to Be Kidding.

The new tax law will increase his profitability immensely. So what he couldn't make as a failed businessman (remember his many bankruptcies?) will now be "corrected" by us, the taxpayers.

Will the loss of the property tax deductions hurt him at all? Misery loves company.

It won't hurt him. The loss of the property tax deduction only applies to residential properties (in which the taxpayer lives,) not commercial properties. Property taxes on commercial properties are a business expense.

eta - You didn't really think that developers would allow that to happen?

Yes but if property taxes are no longer deductible and that lowered property values, the apartments that he sells in his buildings would command less money.

I get that he could take losses for years but work with me here, I need something to hang on to as I prepare to watch my property value sink into the ground.

Morganna said:

cramer said:

Morganna said:

BG9 said:

Trump is highly leveraged, that is, lots of debt.

As is the case with properties owned by most developers, Mr. Trump’s properties appear to be highly leveraged. While he has not disclosed his exact borrowings, he has called himself the “king of debt” and a New York Times investigation found that his companies had borrowed at least $650 million. Other estimates have gone above $1 billion.

Trump Says Tax Bill Will Hurt Him. He’s Got to Be Kidding.

The new tax law will increase his profitability immensely. So what he couldn't make as a failed businessman (remember his many bankruptcies?) will now be "corrected" by us, the taxpayers.

Will the loss of the property tax deductions hurt him at all? Misery loves company.

It won't hurt him. The loss of the property tax deduction only applies to residential properties (in which the taxpayer lives,) not commercial properties. Property taxes on commercial properties are a business expense.

eta - You didn't really think that developers would allow that to happen?

Yes but if property taxes are no longer deductible and that lowered property values, the apartments that he sells in his buildings would command less money.

I get that he could take losses for years but work with me here, I need something to hang on to as I prepare to watch my property value sink into the ground.

That would possibly be the case if his business were comprised of owning and developing real estate, which since he was bankrupted out of that field in the early '90's, is generally not the case. Although his company does own a portion of a few of the properties that bear his name, his business mainly consists of licensing his name to others and managing properties owned by others.

weirdbeard said:

Morganna said:

cramer said:

Morganna said:

BG9 said:

Trump is highly leveraged, that is, lots of debt.

As is the case with properties owned by most developers, Mr. Trump’s properties appear to be highly leveraged. While he has not disclosed his exact borrowings, he has called himself the “king of debt” and a New York Times investigation found that his companies had borrowed at least $650 million. Other estimates have gone above $1 billion.

Trump Says Tax Bill Will Hurt Him. He’s Got to Be Kidding.

The new tax law will increase his profitability immensely. So what he couldn't make as a failed businessman (remember his many bankruptcies?) will now be "corrected" by us, the taxpayers.

Will the loss of the property tax deductions hurt him at all? Misery loves company.

It won't hurt him. The loss of the property tax deduction only applies to residential properties (in which the taxpayer lives,) not commercial properties. Property taxes on commercial properties are a business expense.

eta - You didn't really think that developers would allow that to happen?

Yes but if property taxes are no longer deductible and that lowered property values, the apartments that he sells in his buildings would command less money.

I get that he could take losses for years but work with me here, I need something to hang on to as I prepare to watch my property value sink into the ground.

That would possibly be the case if his business were comprised of owning and developing real estate, which since he was bankrupted out of that field in the early '90's, is generally not the case. Although his company does own a portion of a few of the properties that bear his name, his business mainly consists of licensing his name to others and managing properties owned by others.

If and when this goes through, it seems as if it will be impossible to overturn this as long as the GOP is in control. So we are stuck with it for a very long time.

Morganna said:

Yes but if property taxes are no longer deductible and that lowered property values, the apartments that he sells in his buildings would command less money.

I get that he could take losses for years but work with me here, I need something to hang on to as I prepare to watch my property value sink into the ground.

You're thinking of average middle class Americans to whom the property tax deduction means much.

The people who buy his properties are multi-millionaires such as Russian oligarchs. Most likely the property is bought under a company controlled by the buyer so that all expenses can be deducted. A corporate asset.

Even if the really rich can take a property tax deductions losing it may not be a real loss for them. If you can spend 10 million for a Trump tower residence then a property tax deduction may not matter much.

Leona Helmsley did say "We don't pay taxes. Only the little people pay taxes."

pretty good overview of the pros and cons of eliminating SALT at Vox.com. One very salient point is this:

In other words, the Trump administration isn’t just eliminating SALT. It’s eliminating SALT to, among other things, pay for lower individual income tax rates for the rich. Those two changes, put together, aren’t actually progressive. They could actually be regressive and shift the tax burden from upper-middle-class people benefiting from SALT up to the very rich.

https://www.vox.com/policy-and-politics/2017/10/30/16557554/the-state-and-local-tax-deduction-explained

and even worse than that, it's making upper middle class people in a relative handful of states pay for those tax cuts for the very rich. Not sure there's really any legal ground to win such a suit, since I'm not a lawyer, but if the SALT deduction is eliminated in the final bill, NJ, NY and CA among other states are set to file suit:

One of the more astounding aspects of income inequality in the U.S. isn't just the gap between poor and rich (which is of course pretty extreme), but the tremendous gap between those who are comfortable and those who are super, super rich. Why on earth anyone feels the need to make a NJ executive or lawyer pay for the Koch brothers to be able to buy a couple more super yachts, I don't know.

Mitch McConnell just walked onto the Senate floor and said that he has the votes to pass the tax bill.

Sponsored Business

Promote your business here - Businesses get highlighted throughout the site and you can add a deal.

I'm surprised we haven't started a dedicated thread for this already. The speed that this is going through with very little public support is astounding. ARGHHHHHHHHHHH