What's up with the stock market

yahooyahoo said:

The stock market seems to be completely disconnected from the economy at this point.

From almost everything I've read, we are heading into a recession that will be worse than 08/09. There is historic unemployment in the U.S., U.S. GDP will shrink significantly this year, global GDP will shrink, and almost all major economies in the world will shrink with the exception of China which will basically be flat.

But the Dow has been trending up since early April.

Is this rational behavior?

Somebody answer, quick. I gotta know where to place my bets: Red, black or green?

yahooyahoo said:

The stock market seems to be completely disconnected from the economy at this point.

From almost everything I've read, we are heading into a recession that will be worse than 08/09. There is historic unemployment in the U.S., U.S. GDP will shrink significantly this year, global GDP will shrink, and almost all major economies in the world will shrink with the exception of China which will basically be flat.

But the Dow has been trending up since early April.

Is this rational behavior?

My self directed IRA is at an all time high, by a significant amount but I agree that it doesn't make sense. My IRA contains a number of tech stocks, many of which have reported little to no impact as a result of the global shutdown and have done well despite COVID-19. I am still bullish on the stocks I own, but I am very concerned about the stock market in general. I will be looking to hedge here. Like many, I suspect Q2 earnings to be significantly worse than expected.

On one work project, we are collaborating with a respected economist. He was recognizing the challenges we've experienced here in the NY/NJ areas, while the southern city he lives in has not experienced a Covid-19 surge.

His latest email indicated "I've given up trying to predict what is going to happen next."

Nobody knows what will happen of course. It’s true that Q2 earnings will be very bad compared with 2Q19, but that’s of not going to be of primary importance. The market is all about the forward outlook, and right now there is a reasonable (At least in my estimation) case for a bull market, at least through year-end or so. That case is, economy reopening gains steam with no big Covid setbacks, amid pretty massive monetary and fiscal stimulus.

Will it happen this way? Who knows. But if it does, economic numbers stand to look pretty good within 2-3 quarters.

On what evidence would you ever assume that the stock market is a rational measure of anything other than itself?

I'm not looking this gift horse in the mouth. It's nice not to have a panic attack when I look at my retitrement accounts.

I'm looking to invest in some land in Florida. And ya know what else I hear is gonna rocket up?

Wait for it........

TULIPS ! There are some new yellow ones and everyone's gonna want 'em.

2.5 million jobs added in May, a shocker - Dow futures up 700+ points.

The airline stocks are going crazy.

eta - Actually, everything is.

I can't wait for Trump to take credit for the added jobs despite the fact the economy lost over 20 million jobs in April (non-farm payrolls).

Headline: "What is the stock market even for anymore?"

https://www.nytimes.com/interactive/2020/05/26/magazine/stock-market-coronavirus-pandemic.html

Thoughts?

Like bella, i'm glad to see our retirement savings not tanking for now; but when you look around, how does this market reflect what's happening in the country? Is this another facet of the have/have-not divide, or ??

https://www.nytimes.com/interactive/2020/05/26/magazine/stock-market-coronavirus-pandemic.html

While theories abound, one theme remains dominant: According to a growing number of analysts, investors are pricing in a “near perfect resolution” to the COVID-19 crisis, State Street Global Advisors chief investment strategist Michael Arone, told Yahoo Finance this week.

“Investors are looking beyond the current environment and they’re looking at the fact that policymakers have put forward a firm commitment to do what it takes ... and they’re expecting recovery,” Arone said, even as current market psychology looks like “a head-scratcher” to some.

“There are a number of risks on the horizon but ... if you believe that on the other side of the pandemic, we’ll return to some element of economic growth with very low rates, benign inflation and ... incredible support in both fiscal and monetary policy, that has historically been a very strong backdrop” for markets, he added.

Well, I 100% hope the optimists (and experts) are right, but we will need an awful lot of "new" jobs to make up for sectors that don't look like they will be coming back to full strength anytime soon, look at store-based retail and in-person hospitality and entertainment. Example: here in Wisconsin, restaurants are permitted to open today for indoor seating, but only at 25% of capacity. How does a place that had been working on a narrow margin make a go of it at 25%? How do places near theaters and arenas make a go without shows and games going on?

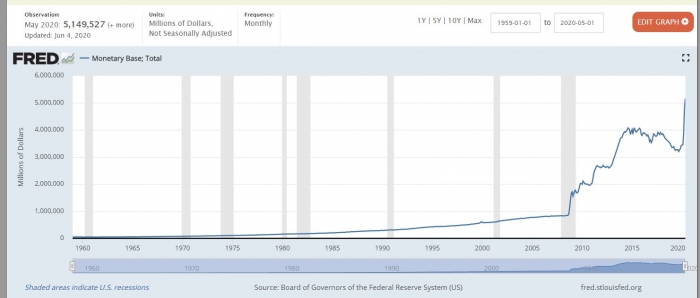

Anticipated earnings are only one factor in the stock market's value, although a crucial one over a long time span. Another big factor in the short term is supply and demand, which is significantly influenced by the Fed. In the last few months the Fed has committed to basically spending trillions on backing up corporate bonds, even of a high risk quality, and pumping money into the economy. The Fed is pumping almost more money into the economy than companies are losing in profits. Someday it may be time to pay it back, or the spigots may be shut off. In the meantime there is so much money sloshing around, that it has to be put to use somewhere, and interest rates can't go much lower, so voila.

yahooyahoo said:

The stock market seems to be completely disconnected from the economy at this point.

From almost everything I've read, we are heading into a recession that will be worse than 08/09. There is historic unemployment in the U.S., U.S. GDP will shrink significantly this year, global GDP will shrink, and almost all major economies in the world will shrink with the exception of China which will basically be flat.

But the Dow has been trending up since early April.

Is this rational behavior?

The unknown at this point is - what will the affect of a strong stock market have on local and state governments?

Most of the bailout money is responsible for the unemployment numbers. Wasn't rehiring part of the deal for loans to be forgiven?

--------------------------------------

And again - debt no longer matters. Will they ever matter - if so, when?

In 2000 the GDP to debt ratio was 57.68% currently it's 125.07%

Here's the projection at current rates for 2024:

Rehiring was a condition, but the Senate just watered it down.

https://www.cnn.com/2020/06/03/politics/paycheck-protection-program-senate/index.html

Before the virus hit, people were debating whether the long, long running bull market could possibly continue. That debate seems to have been all but forgotten, even though many additional negative factors have now come into play.

It also troubles me greatly to see how much the gap between rich and poor continues to widen. Shop owners and jobholders are worrying about paying their rent or mortgages while investors and analysts rejoice over the market regaining its highs. Seems to me this is a recipe for significant civil unrest, no doubt exacerbated by Trump's words and actions.

And what if the virus does indeed come back in a second wave in the fall? Can you imagine trying to persuade people to shut down again?! If that happens, the market will be going down 1,000 points instead of up . . . .

To answer the op:

- People at home in front of their computers;

-Zero cost commissions;

- Ability to buy fractional shares, started by Robinhood and adopted by other firms.

One person on Twitter just posted " When do Robinhood traders have to go back to work? I want fair warning"

And a response (which is true) " It's easy to clown on them, but I think they've done better than most professional traders during this time around."

And the reply " I love this...I just want to know before its going to end!"

unicorn33 said:

Before the virus hit, people were debating whether the long, long running bull market could possibly continue. That debate seems to have been all but forgotten, even though many additional negative factors have now come into play.

It also troubles me greatly to see how much the gap between rich and poor continues to widen. Shop owners and jobholders are worrying about paying their rent or mortgages while investors and analysts rejoice over the market regaining its highs. Seems to me this is a recipe for significant civil unrest, no doubt exacerbated by Trump's words and actions.

And what if the virus does indeed come back in a second wave in the fall? Can you imagine trying to persuade people to shut down again?! If that happens, the market will be going down 1,000 points instead of up . . . .

It is a weird bull market. A second wave may cut it by not 1,000 but by over 10,000.

Being in the in the market does not mean one is rich. Shop owners and individuals often keep their savings in the market. Who in this day and age parks money in banks offering near zero percent interest that does not even keep up with inflation? Many jobholders and retirees have pension funds that are heavily market invested.

Even without a second wave we may not be out of the water. Restaurants, hotels, cruise lines and transportation is ramping up but what happens when many customers don't show? The restaurant that is rehiring now may have to cut back or even close when they lose half of their customers. The transit agencies may have to cut services and employees.

It may seem obvious, with double-digit unemployment and plunging economic output. But if there was any remaining doubt that the U.S. is in a recession, it's now been removed by the official scorekeepers at the National Bureau of Economic Research.

The bureau's Business Cycle Dating Committee — the fat lady of economic opera — said the expansion peaked in February after a record 128 months, and we've been sliding into a pandemic-driven recession since.

In making the announcement, the committee pointed to the "unprecedented magnitude of the decline in employment and production, and its broad reach across the entire economy."

At the same time, the committee noted the recession could be short-lived. The U.S. added 2.5 million jobs last month after losing more than 22 million in March and April. Many forecasters said they expect economic output to begin growing again in the third quarter.

The standard definition of a recession is "a decline in economic activity that lasts more than a few months." The committee decided this downturn is so severe it earns the recessionary title, even if the recovery begins quickly.

From an official point of view, recessions "end" when the economic bleeding stops, even if it takes years for the patient to make a full recovery.

Sponsored Business

Promote your business here - Businesses get highlighted throughout the site and you can add a deal.

The stock market seems to be completely disconnected from the economy at this point.

From almost everything I've read, we are heading into a recession that will be worse than 08/09. There is historic unemployment in the U.S., U.S. GDP will shrink significantly this year, global GDP will shrink, and almost all major economies in the world will shrink with the exception of China which will basically be flat.

But the Dow has been trending up since early April.

Is this rational behavior?